Manage Customer Credit Limits in Business Central

- maique00

- Sep 20, 2022

- 2 min read

Most of companies have in place a policy to manage the Customer Credit Limits to mitigate risk of payment failure.

When using D365BC as your ERP, there are several options to setup this functionality.

Option 1: No Credit Warnings

Search Sales & Receivables Setup and under General FastTab, populate field “Credit Warning” with “No Warning” option selected. This configuration won’t pop-up any notifications to End User.

Option 2: Warnings (No Block)

Search Sales & Receivables Setup and under General FastTab, populate field “Credit Warning” with “Credit Limit” option selected. This configuration in combination with Credit Limit configured at Customer card level will pop-up a notification for End User when the customer is over the credit limited.

Important Notes:

· Credit Limit (LCY) with 0,00 means unlimited credit limit and No credit limit. If a customer does not have any credit, the Credit Limit (LCY) should be updated to 0.01.

· Credit Limit control is verified against the Bill-To-Customer No.

· The formula used to calculate the Total Balance (LCY) against the Credit Limit is: Balance (LCY) + Outstanding Amount (LCY) + Shipped not Invoiced (LCY).

Balance (LCY) – Remaining Amount (LCY) in Posted Documents

Outstanding Amount (LCY) – Open Sales Orders Amount (LCY) not Shipped and not Invoiced

Shipped not Invoiced (LCY) – Sales Orders Amount Shipped not Invoiced (LCY)

When a new document is created for this customer with this configuration, a notification will pop-up if the balance is over the credit limit.

End User is able to confirm and Release the Sales document. It’s a notification and not a blocker.

Option 3: Hard Blocker

The previous option triggers the notification pop-up but allows the end user to Release the Sales document.

This third option configuration will block the end user to stop new Sales when the balance is over the credit limit.

To achieve that, it is required to follow this configuration:

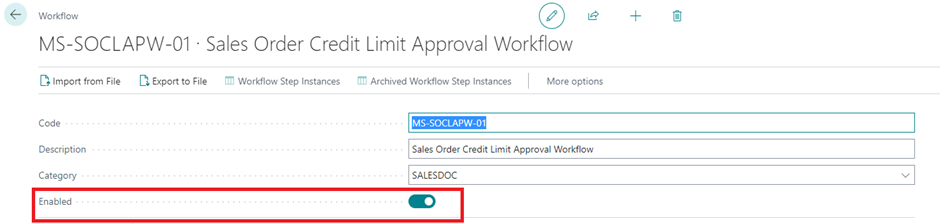

Setup a new Workflow based in template “Sales Order Credit Limit Approval Workflow”

Search Workflows, select New, New from Workflow Template.

A new workflow will be created, and it will be required small tweaks in order to fit to each customer reality.

Under step “A customer credit limit is exceeded.” in Response “Create an approval request for the record using approver type Approver and approver limit type Specific Approver.”, the criteria for the approval should be updated.

This configuration will send all the workflows approvals (when the customer credit limit is exceeded) to the user CFO. There is a couple of options to setup the Approval User Setup besides this simple example.

Last step is to enable this workflow.

Now, every Sales Order should be submitted for workflow approval (Request Approval > Send Approval Request) instead of Release.

The Release option won’t work anymore!

This third option allows to control Customer Credit Limits with hard blocks without any customization or extension.

what is the best way to customize the control to include some other amounts from other documents?